Elections Canada Quarterly Financial Report 2011-2012 – For the quarter ended December 31, 2011

Statement outlining results, risks and significant changes in operations, personnel and program

Introduction

This quarterly financial report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates and Supplementary Estimates.

The Office of the Chief Electoral Officer, commonly known as Elections Canada, is an independent, non-partisan agency that reports directly to Parliament. Its mandate is to:

- be prepared at all times to conduct a federal general election, by-election or referendum

- administer the political financing provisions of the Canada Elections Act

- monitor compliance with and enforce electoral legislation

- conduct voter education and information programs

- provide support to the independent commissions in charge of adjusting the boundaries of federal electoral districts following each decennial census

- carry out studies on alternative voting methods and, with the approval of Parliament, test on-line voting processes for future use during electoral events

A summary description of the Agency's program activities can be found at http://www.tbs-sct.gc.ca/rpp/2011-2012/inst/ceo/ceo01-eng.asp#sec1

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the Agency's spending authorities granted by Parliament and those used by the Agency consistent with the Main Estimates for the 2011-2012 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes. With respect to Elections Canada, the Canada Elections Act, the Electoral Boundaries Readjustment Act and the Referendum Act provide for all expenditures with the exception of salaries of indeterminate employees, which are funded through an annual appropriation.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

Elections Canada uses the full accrual method of accounting to prepare and present its annual audited departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

This quarterly report has not been subject to an external audit or review.

Highlights of fiscal quarter and fiscal year to date (YTD) results

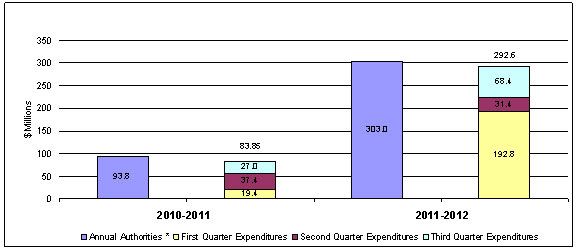

In the first three quarters of 2011-2012, total budgetary expenditures were $292.6 million compared to $83.9 million in the same period of 2010-2011. The $208.7 million increase is due to the delivery of a general election. During the first three quarters of the 2011-2012 fiscal year, Elections Canada delivered and carried out post-event activities for the 41st general election (polling day of May 2, 2011) while in the same period of the prior fiscal year, the agency conducted election readiness activities in the second year of a minority government.

Budgetary expenditures in the third quarter of 2011-2012 were $68.4 million compared to $27.0 million in the same quarter of 2010-2011. This $41.4 million net increase is due to $38.5 million in reimbursements to candidates and political parties in the 41st general election, $7.5 million in quarterly allowances to political parties (due to timing differences), $2.2 million in other expenses pertaining to the 41st general election and $6.8 million less for election readiness, operating, project and by-election expenditures.

Finally, the 2011-2012 third quarter expenditures of $68.4 million were significantly higher than $31.4 million in the second quarter as a large proportion of payments related to the reimbursement of candidates and political parties in the 41st general election were disbursed.

Figure 1 - First, Second and Third Quarter Expenditures Compared to Annual Authorities (Appropriation and Statutory Authority) *

* Annual Authorities for statutory funds reflect expenditures for the first three quarters only since statutory authorities are granted as expenditures are incurred.

Click here for a textual description of Figure 1.

Risks and Uncertainties

Budget 2010 announced that the operating budgets of departments would be frozen at their 2010-2011 levels for the fiscal years 2011-2012 and 2012-2013. This has an impact on Elections Canada's appropriation, which covers the salaries of our indeterminate staff. For the next two fiscal years, we will not be funded for salary increases and are therefore taking steps to absorb increases resulting from collective agreements.

Elections Canada's expenditures are influenced by the frequency and number of electoral events (general elections, by-elections) and by infrequent exercises such as the electoral district boundaries redistributions and referenda. Any of these events could significantly change expenditures from one fiscal year to the next.

Significant changes in relation to operations, personnel and programs

As mentioned above, Elections Canada was delivering the 41st General Election during the first three quarters of 2011-2012 and will close out this general election (reporting, evaluations, compliance auditing, etc.) throughout the balance of the fiscal year and into 2012-13.

Approval by Senior Officials

Marc Mayrand

Chief Electoral Officer of Canada

Helen J. Bélanger, CMA

Chief Financial Officer

Ottawa, Canada

February 29, 2012

Table A.1

Elections Canada

Quarterly Financial Report

For the quarter ended December 31, 2011

Statement of Authorities (unaudited)

| (in thousands of dollars) | Total available for use for the year ending March 31, 2011* | Used during the quarter ended December 31, 2010 | Year to date used at quarter-end |

|---|---|---|---|

| Vote 15 – Program expenditures | 30,938 | 6,820 | 21,010 |

| Budgetary statutory authorities* | 62,842 | 20,186 | 62,842 |

| Total Budgetary authorities | 93,780 | 27,006 | 83,852 |

| Non-budgetary authorities | - | - | - |

| Total authorities | 93,780 | 27,006 | 83,852 |

| (in thousands of dollars) | Total available for use for the year ending March 31, 2012* | Used during the quarter ended December 31, 2011 | Year to date used at quarter-end |

|---|---|---|---|

| Vote 15 – Program expenditures | 32,875 | 7,583 | 22,463 |

| Budgetary statutory authorities* | 270,124 | 60,855 | 270,124 |

| Total Budgetary authorities | 302,999 | 68,437 | 292,587 |

| Non-budgetary authorities | - | - | - |

| Total authorities | 302,999 | 68,437 | 292,587 |

More information is available in Table A.2

* Budgetary statutory authorities amounts in the "Total available for use for the year ending March 31, 201x" columns reflect expenditures for the first three quarters only since statutory authorities are granted as expenditures are incurred.

Table A.2

Elections Canada

Quarterly Financial Report

For the quarter ended December 31, 2011

Departmental budgetary expenditures by Standard Object (unaudited)

| Expenditures: | Planned expenditures for the year ending March 31, 2011* | Expended during the quarter ended December 31, 2010 | Year to date used at quarter-end |

|---|---|---|---|

| Personnel** | 44,900 | 12,898 | 34,973 |

| Transportation and communications | 4,230 | 2,257 | 4,230 |

| Information | 2,672 | 1,211 | 2,672 |

| Professional and special services | 19,487 | 7,765 | 19,487 |

| Rentals | 3,662 | 1,447 | 3,662 |

| Repair and maintenance | 1,930 | 685 | 1,930 |

| Utilities, materials and supplies | 747 | 331 | 747 |

| Acquisition of land, buildings and works | 15 | 1 | 15 |

| Acquisition of machinery and equipment | 1,292 | 521 | 1,292 |

| Transfer payments | 14,747 | (114) | 14,747 |

| Public debt charges | - | - | - |

| Other subsidies and payments | 98 | 4 | 98 |

| Total gross budgetary expenditures | 93,780 | 27,006 | 83,852 |

| Less Revenues netted against expenditures: | |||

| Revenues | - | - | - |

| Total Revenues netted against expenditures | - | - | - |

| Total net budgetary expenditures | 93,780 | 27,006 | 83,852 |

| Expenditures: | Planned expenditures for the year ending March 31, 2012* | Expended during the quarter ended December 31, 2011 | Year to date used at quarter-end |

|---|---|---|---|

| Personnel** | 142,043 | 11,731 | 131,632 |

| Transportation and communications | 27,713 | 1,127 | 27,713 |

| Information | 16,698 | 991 | 16,698 |

| Professional and special services | 23,607 | 6,487 | 23,607 |

| Rentals | 20,488 | 1,209 | 20,488 |

| Repair and maintenance | 3,373 | 755 | 3,373 |

| Utilities, materials and supplies | 1,521 | (419) | 1,521 |

| Acquisition of land, buildings and works | 297 | 4 | 297 |

| Acquisition of machinery and equipment | 1,022 | 423 | 1,022 |

| Transfer payments | 66,207 | 46,125 | 66,207 |

| Public debt charges | - | - | - |

| Other subsidies and payments | 28 | 5 | 28 |

| Total gross budgetary expenditures | 302,999 | 68,437 | 292,587 |

| Less Revenues netted against expenditures: | |||

| Revenues | - | - | - |

| Total Revenues netted against expenditures | - | - | - |

| Total net budgetary expenditures | 302,999 | 68,437 | 292,587 |

* Statutory expenditures in the "Planned expenditures for the year ending March 31, 201x" columns reflect expenditures for the first three quarters only since statutory authorities are granted as expenditures are incurred.

** Personnel expenditures include both Vote 15 – Program expenditures and Budgetary statutory authorities; all other categories of expenditures are solely Budgetary statutory.