Political Financing Handbook for Third Parties, Financial Agents and Auditors – June 2021

To be used for non-fixed-date general elections and by-elections

1. Reference Tables and Timelines

The reference tables and timelines in this chapter are quick reference tools for the use of third parties, financial agents and auditors.

The chapter contains the following:

- Definition of terms: third party, regulated activities and issue-based activities

- Registration: requirements and eligibility

- Role and appointment process—financial agent

- Role and appointment process—auditor

- Important deadlines

- Interim reporting requirements for a non-fixed-date general election

Definition of terms

What is a third party?

During an election period, a third party is a person or group other than a:

- registered party

- registered electoral district association

- unregistered electoral district association of a registered party

- candidate

Note: The election period starts on the day the election is called and ends on election day when the polls close.

What are regulated activities?

This handbook uses "regulated activities" as an umbrella term for election advertising, partisan activities and election surveys.

The following table introduces the regulated activities. For full definitions and examples, see chapters 5 to 7 on each type of regulated activity in an election period.

| Regulated activities | Description |

|---|---|

| Election advertising | The transmission to the public by a third party, by any means during the election period, of an advertising message that promotes or opposes a registered party or candidate, including by taking a position on an issue with which the registered party or person is associated. |

| Partisan activities | Activities carried out by a third party that promote or oppose a political party, nomination contestant, potential candidate, candidate or party leader, other than by taking a position on an issue with which the political party or person is associated. Note: Activities to fundraise for the third party are excluded from partisan activities. As well, activities that meet the definition of election advertising are only election advertising, not also partisan activities. |

| Election surveys | Surveys about voting intentions or choices, or about an issue with which a registered party or candidate is associated, that a third party conducts or causes to be conducted during the election period. The survey results are used in deciding whether or not to organize and carry out regulated activities, or in the organization and carrying out of regulated activities. |

Note: A potential candidate is someone who is selected in a nomination contest, is deemed to be a candidate because they have conducted political financing transactions, is a member of Parliament or an incumbent, or has the support of a political party to be a candidate of that party.

Note: Partisan activities or election surveys conducted by provincially registered political parties are not regulated for the purposes of the Canada Elections Act. Their election advertising, however, is regulated. Activities or messages compelled by provincial legislation are also not regulated.

Which issue-based activities are regulated?

Some issue-based activities that take place during an election period are covered by the third party rules. Others are not. This table shows the different types and what makes them regulated.

See Chapter 5, Regulated Activities: Election Advertising in an Election Period for information on determining which issues are associated with a registered party or candidate.

| Activity during the election period | Only takes a position on an issue | Also identifies a party or candidate |

|---|---|---|

Election advertising Examples:

|

Regulated, if the issue is clearly associated with a party or candidate |

Regulated |

Partisan activity Examples:

|

Not regulated |

Regulated |

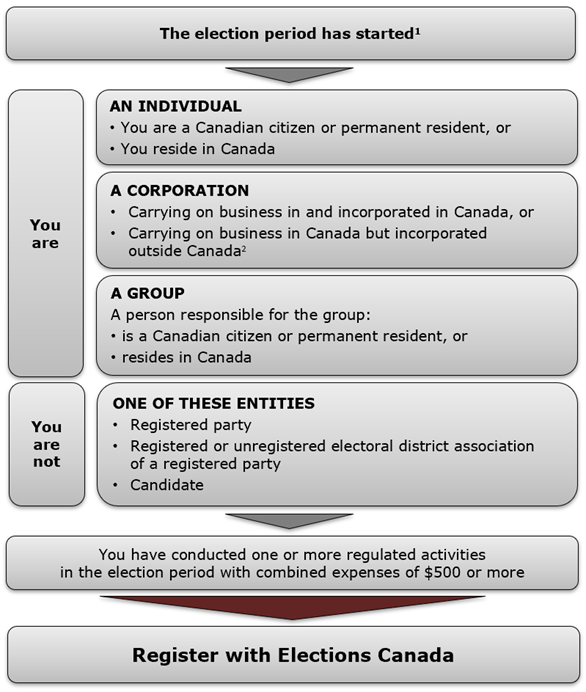

Registration: Requirements and eligibility

Text version of "Registration: Requirements and eligibility"

You are considered a third party and are required to register with Elections Canada if:

- The election period has started

- You fall into one of these categories:

- An individual who is a Canadian citizen or permanent resident, or resides in Canada

- A corporation that carries on business in Canada and is incorporated in Canada

- A corporation that carries on business in Canada but was incorporated outside Canada, unless during the election period its primary purpose in Canada is to influence electors to vote or refrain from voting

- A group, if a person responsible for the group is a Canadian citizen or permanent resident, or resides in Canada

- You are not a registered party, a registered or unregistered electoral district association of a registered party, or a candidate; and

- You have conducted one or more regulated activities in the election period with combined expenses of $500 or more

1 The election period starts on the day the election is called and ends on election day when the polls close.

2 A foreign corporation cannot register as a third party if, during the election period, its primary purpose in Canada is to influence electors to vote or refrain from voting, either in general or for a particular candidate or registered party.

Note: A third party may choose to register if the election period has started and it intends to conduct regulated activities with combined expenses totalling $500 or more.

Role and appointment process—financial agent

Third party's financial agent

Role summary

- The financial agent is responsible for administering the third party's financial transactions related to regulated activities during the election period and for reporting those transactions to Elections Canada as required by the Canada Elections Act.

- The financial agent may authorize another person to accept contributions or incur expenses for regulated activities, but that does not limit the responsibility of the financial agent.

- The financial agent's role continues until the third party fulfills all financial reporting requirements.

| Who is eligible? | Yes / No |

|---|---|

| Canadian citizen | Yes |

| Permanent resident of Canada | Yes |

| Candidate or their official agent | No |

| Chief agent or registered agent of a registered party | No |

| Election officer or member of the staff of a returning officer | No |

| Any other person or group not mentioned above | No |

Appointment process

- When the third party applies to register, it must submit the General Form—Third Party. This form must include the financial agent's name, address and telephone number.

- The financial agent has to sign a statement consenting to act in that capacity.

- If for any reason the financial agent is no longer able to continue in that role, the third party must appoint a new financial agent and notify Elections Canada without delay. The notice has to include a signed consent from the new financial agent.

- Although it is not a legal requirement, a financial agent should be experienced in managing finances. The role requires a strong ability to control, record and administer financial transactions as well as to create financial reports.

Role and appointment process—auditor

Third party's auditor

Role summary

- The auditor, if one is required, has to examine the third party's financial records and give an opinion in a report as to whether the third party's financial return presents fairly the information contained in the financial records on which it is based.

- The auditor has a right to access all documents of the third party, and may require the third party or the financial agent of the third party to provide any information or explanation that is necessary to enable the auditor to prepare the report.

| Who is eligible? | Yes / No |

|---|---|

| Person who is a member in good standing of a corporation, an association or an institute of provincially accredited professional accountants (CPA designation)* | Yes |

| Partnership of which every partner is a member in good standing of a corporation, an association or an institute of provincially accredited professional accountants (CPA designation)* | Yes |

| Third party's financial agent | No |

| Person who signed the third party's application for registration | No |

| Election officer or member of the staff of a returning officer | No |

| Candidate or their official agent | No |

| Chief agent or registered agent of a registered party or eligible party | No |

| Any other person or group not mentioned above | No |

Appointment process

- If the third party incurs expenses totalling $10,000 or more for regulated activities conducted during the election period, an auditor must be appointed.

- The auditor has to sign a statement consenting to act in that capacity.

- The third party must notify Elections Canada about the appointment without delay. If for any reason the auditor is no longer able to continue in that role, the third party must appoint a new auditor and notify Elections Canada without delay. The notice has to include a signed consent from the new auditor.

*Provincially or territorially legislated accounting bodies may require auditors to meet other professional criteria in order to perform this role, such as holding a public accounting licence in the province or territory where the political entity is based and only accepting assignments that avoid a conflict of interest. This should be discussed with the auditor before the appointment.

Note: For a guide to preparing the auditor's report, please refer to guidance produced by the Chartered Professional Accountants of Canada. A link to the guide is posted on the Elections Canada website.

Note: The Canada Elections Act does not provide a subsidy in relation to audit services for registered third parties.

Important deadlines

Election is called

Registration1

If the third party has conducted one or more regulated activities in the election period with combined expenses totalling $500 or more:

- Appoint a financial agent if this has not yet been done2

- Appoint an auditor, if required3

- Register with Elections Canada immediately

To register, the financial agent sends Elections Canada:

- General Form—Third Party

21 days before election day (general election only)

Financial agent sends Elections Canada:

- Third Party's Interim Campaign Return (first return, if applicable)4

7 days before election day (general election only)

Financial agent sends Elections Canada:

- Third Party's Interim Campaign Return (second return, if applicable)4

Election day

4 months after election day

Financial agent sends Elections Canada:

- Third Party's Electoral Campaign Return (with supporting documents)

- Auditor's report (if applicable)5

1 Not every person or group is eligible to register. See Registration: Requirements and Eligibility earlier in this chapter.

2 Every contribution made to a registered third party during an election period for regulated activities and every regulated expense incurred during an election period must be accepted and authorized, respectively, by the financial agent or a person authorized in writing by the financial agent.

3 An auditor must be appointed without delay after the third party incurs expenses totalling $10,000 or more for regulated activities conducted during the election period.

4 Interim reports are required if the $10,000 threshold for regulated contributions or expenses is reached. See Interim reporting requirements for a non-fixed-date general election below.

5 An auditor's report is required if the third party incurred expenses totalling $10,000 or more for regulated activities conducted during the election period.

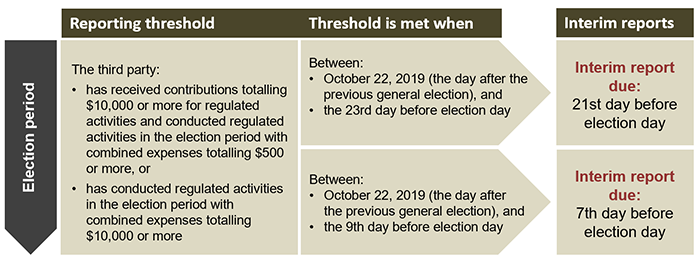

Interim reporting requirements for a non-fixed-date general election

Text version of "Interim reporting requirements for a non-fixed-date general election"

Interim reports are required during the election period when the third party reaches one of these thresholds:

- received contributions totalling $10,000 or more for regulated activities and conducted regulated activities in the election period with combined expenses totalling $500 or more, or

- conducted regulated activities in the election period with combined expenses totalling $10,000 or more

If a threshold is met between October 22, 2019, and the 23rd day before election day, an interim report is due on the 21st day before election day.

If a threshold is met between October 22, 2019, and the 9th day before election day, an interim report is due on the 7th day before election day.

Note: If a third party files the first interim report, it must also file the second interim report. There are no interim reporting requirements for by-elections.

Examples

- Election day is February 25, 2022. On January 31, the third party passes the $10,000 threshold in contributions received for regulated activities. That day, it also conducts a regulated activity with an expense of $500 and is required to register. The third party must submit two interim reports:

- on February 4, for the period between October 22, 2019, and February 2, 2022

- on February 18, for the period between February 3 and February 16, 2022

- Election day is February 25, 2022. On January 31, the third party buys TV ads for $10,000 that will run on February 15, promoting a registered party. Because the ads are running after the end of the first reporting period, the third party must submit only one interim report:

- on February 18, for the period between October 22, 2019, and February 16, 2022